"2024 India Bangalore Electric and Charging Station Expo GV Expo 2024

Find exhibitions, visit ExpoCircle!"

"2024 India Bangalore Electric and Charging Station Expo

The 7th GV Expo 2024

Exhibition Dates: June 7-9, 2024

Venue: Bangalore, India

Exhibition Cycle: Biennial, 7th edition

Organizer: Media Day Marketing

Concurrent Event: 2024 India Automotive Technology and Accessories Exhibition

China Representative: Oriental Futa (Beijing) International Exhibition Co., Ltd.

Exhibition Overview:

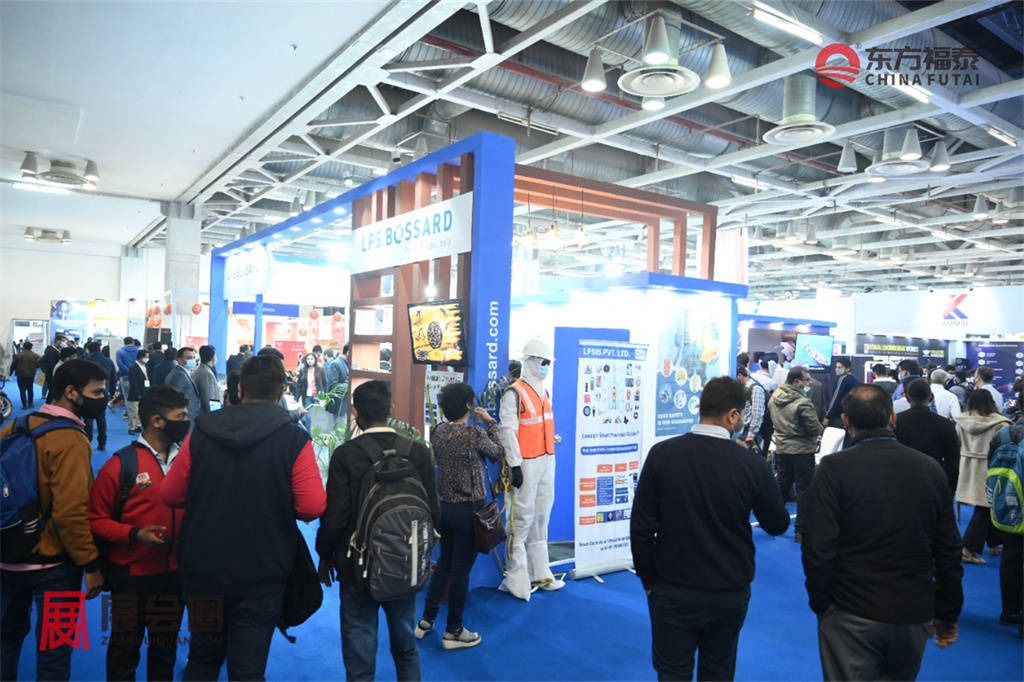

The 2024 India Bangalore Electric and Charging Station Expo (GV Expo) is a premier event that brings together global leading technologies and innovations, aiming to drive the development of the new energy vehicle industry. As the exhibition consultant, I am delighted to introduce you to this significant event in the industry.

The 2024 India Bangalore Electric and Charging Station Expo (GV Expo) will be held in the fall of 2024 at the International Convention Center in Bangalore, spanning three days. This exhibition serves as a platform to showcase the latest electric vehicle technologies, charging equipment, and industry innovations. Moreover, it acts as a gathering place for industry experts, manufacturers, policymakers, and consumers to engage in meaningful discussions. The expo will feature various vehicle models, including electric cars, motorcycles, bicycles, and commercial vehicles, along with the latest charging station technologies, including fast-charging stations and wireless charging technology.

In addition to product exhibitions, the 2024 India Bangalore Electric and Charging Station Expo (GV Expo) will host a series of seminars and workshops covering cutting-edge topics such as battery technology, charging solutions, connected vehicles, and autonomous driving. These activities will provide participants with the opportunity to gain insights into the latest market trends and foster collaboration and communication within the industry.

The 2024 India Bangalore Electric and Charging Station Expo (GV Expo) places a special emphasis on networking, providing professionals in the industry with an excellent opportunity to facilitate the establishment of partnerships and exchange experiences. Furthermore, the expo collaborates with numerous media partners to ensure extensive industry coverage and influence.

Exhibition Categories:

1.New Energy Vehicles: Electric vehicles, Connected autonomous vehicles, Light Electric Vehicles (LEV) weighing less than 350kg, Electric motorcycles, Electric three-wheeled vehicles, Electric scooters, Electric bicycles, Electric toy vehicles, Electric golf carts, Electric commercial vehicles, Electric buses, Connected autonomous trucks (LKWs), Electric buses (total), Connected and autonomous buses, Electric forklifts, Electric vehicle transportation and storage, Electric vehicle recovery, Electric ambulances, Electric senior citizen vehicles, Electric and hybrid boats and ships, Electric airplanes, Other vehicles, Accessories, Vehicle services, Vehicle certification, Vehicle testing.

2.Energy and Infrastructure: Power energy suppliers, Hydrogen energy suppliers, Energy infrastructure, Energy networks, Energy management, Smart grids (V2G), Electrical cables, connectors, plugs, Charging piles, Charging stations, Power stations, Solar garages, Hydrogen stations, Fast-charging stations, Charging system inductors, Energy and charging systems.

3.Battery and Powertrain, Battery Technology:Battery systems, Lithium batteries, Lead-acid batteries, Nickel batteries, Other batteries, Battery management, Battery charging systems, Battery testing systems, Capacitors, Supercapacitors, Cathodes, Storage batteries, Fuel cell technology, Fuel cell systems, Fuel cell management, Hydrogen tanks, Hydrogenation, Powertrains, General motors, Hub motors, Asynchronous engines, Synchronous engines, Hybrid engines, Series hybrid powertrain engines, Other hybrid powertrain engines, Cable weaving machines and automotive wiring, Drive systems, Transmissions, Brake technology and components, Wheels, Engine certification, Engine testing, Other powertrain components.

4.Mobile Concepts:Mobile concepts, Car-sharing, Lifestyle, Intermodal mobility, Tourism, Finance, Banking, Financing, Leasing, Venture capital, New sales concepts, Insurance, Services, Education, Public authorities, Cities, Research institutions, Universities, Consulting, Training, Associations, Media, Trade media, Other services.

5. Information Entertainment and Communication:Automotive communication, Vehicle-to-vehicle communication, Vehicle-to-road communication, Navigation systems, Applications, Displays (LED, LCD, others), Sound systems, Voice recognition, In-car video, In-car internet, In-car television, WiFi hotspots, Location-based services (LBS), Social networks, Games, Hands-free calling, Offline and hybrid navigation, Web services and multimedia, Remote door lock/unlock, Telecommunication infrastructure and traffic management, Satellite positioning (BeiDou, GPS, Galileo, etc.), Connectivity (4G, 5G, LTE, etc.), Network access devices, Roadside infrastructure, Antennas, Remote information processing, Traffic management systems, Traffic signs, Parking management systems, Parking lots, and fee systems, Information and communication technology, Operating systems, Programming and tools, Cloud computing, Big data, IT security, Embedded systems, Shared media, Mobile communication devices, Transmission systems (GSM, LTE, Bluetooth, etc.), ICT.

6. Autonomous Driving:Autonomous safety systems, Passive safety systems, Adaptive cruise control (ACC), Blind spot detection (BSD), Lane departure warning systems (LDW), Pedestrian detection, Pre-collision warning, Collision prevention systems, General warning systems, Autonomous disaster reduction systems, Strain gauges, Pressure pads, Night vision, Driver assistance systems, Driver monitoring systems, Monitoring systems, Automotive speed control systems (ACC and ISA), Driving behavior analysis, Biostatistical control systems, Driver behavior monitoring, Driver monitoring systems, Safety and security services, Emergency call (eCall), Roadside assistance/group call (bCall), Vehicle tracking, Geofencing, Remote deceleration and immobilization, Safety and security services, Electronics and sensors, Light detection and ranging, Cameras, Radars, Light detection and ranging, Ultrasonic sensors, Control systems, Power electronics, Diodes, Transistors, Integrated circuits, Optoelectronic products, PCBs, Test systems, Test services, Electrical safety, Other electronic products.

7. **Urban and Mobility Design:**HMI, Displays, Users, Interfaces, Augmented reality, Communication design, Graphic design, Interior lightweight design, Vehicle design, Automotive body design, Frame design, Product design, Wear-resistant technology, Accessibility, Interface design, Lightweight design, Sustainable design, Lighting design, Interior lightweight design, Urban design and architecture, Urban planning, Traffic planning, Road, Parking rearrangement, Multimodal transportation, Urban design and architecture, Design and development tools, Additive manufacturing (3D printing), Simulation, Computer-aided design (CAx software), PLM, Bionics, Rapid prototyping, Modeling, Design development tools, Other.

8. Materials and Engineering:Materials, Components, and Semi-finished Products, Materials for Batteries and Powertrains, Anode Materials, Washers, Sealants, Electrolytes, Expanders, Foils/Films, Casing Materials, Racks, Additives, Inhibitors, Ion Conductors, Ion Polymers, Cables and Wires, Catalysts, Cathode Materials, Contact Materials, Solvents, Adhesives, Battery Connectors, Reaction Layers, Reference Electrodes, Carbon Black, Tubes and Pipes, Separators, Sintering Plates, Valves, Interconnection Techniques, Casting Compounds, Shutters, Aggregation, Other Energy Storage Materials, Metals, Ceramics, Surface Technology, Nanomaterials and Smart Materials, Composite Materials, Resins, Additives, Auxiliaries, and Fillers, Fibers, Filaments, and Yarns, Fabrics, Composite Materials, Plastics, Textile Materials, Natural Materials, Adaptive Materials, Vehicle Manufacturing, Production, Joining, Cutting; Adhesive and Sealant Technology, Welding, Brazing, Heat Treatment, and Vacuum Technology, Casting, Powder Technology, Forming/Molding, Turning/Milling, Property Modification, Material Technology, Material Testing and Measurement, Mechanical Tests, Non-destructive Testing, Optical and Microscopic Testing, Thermal Analysis, Other Material Testing, Vehicle Components, Parts, Airbags, Acoustics, Body, Chassis, Steering, Hydraulic, Pneumatic, Electromechanical Integrated Machines, Appearance Displays, etc.

9. Maintenance and Spare Parts:Maintenance, Retrofitting, Tools, Diagnostic and Testing Equipment, Mechanical Repair Equipment, Operational Supplies, Tire Repair Equipment, Lifting Equipment, Heating, Air Conditioning/Ventilation, Commodities, Washing and Cleaning Systems, Trailers, Mobile Workshop Equipment, Starting/Ignition Equipment, Fasteners, Technician Equipment, Garage Training, Rescue Training, Accessories, Drive and Motor Parts, Electrical Parts, Electronic Parts, Chassis Parts, Brake System Parts, Tires, Lighting, Body Equipment, HVAC Equipment, Interior Equipment, etc.

Market Overview:

I. Analysis of the New Energy Electric Vehicle and Charging Station Market in Bangalore, India

Bangalore, known as the Silicon Valley of India, boasts a robust technological foundation and innovation capabilities. With the global push for carbon neutrality, the Indian government is actively promoting the electrification of automobiles to reduce greenhouse gas emissions and improve air quality. The government has allocated substantial subsidies for the deployment of charging infrastructure, increasing from 10 billion rupees in 2018 to the current 100 billion rupees.

By 2025, the market for new energy electric vehicles and charging stations in Bangalore, India, is expected to continue its growth trajectory. This growth is primarily driven by government policy support, increasing environmental awareness, and advancements in technology. As electric vehicle technology matures and costs decrease, more consumers and businesses are adopting electric vehicles for their daily transportation needs.

India, with its vast population, has attracted numerous manufacturers of new energy electric vehicles due to its enormous market potential. Bangalore, as a rapidly developing city, is witnessing a growing demand for new energy electric vehicles. While India's development of electric vehicles lags behind regions like China, Europe, and North America, the continuous decline in the cost of lithium-ion batteries and the surge in fossil fuel prices are expected to significantly drive the growth of the electric vehicle market.

To regulate the construction and development of charging facilities for electric vehicles, the Indian government introduced the "Guidelines and Standards for Electric Vehicle Charging Infrastructure" as early as 2018, updated in 2022 to incorporate revisions from the preceding years. The updated guidelines specify the construction density of charging stations, requiring at least one public charging station within a 3km x 3km interval, one public charging station every 25km, and at least one fast-charging station every 100km.

Despite government support and market potential, the new energy electric vehicle and charging infrastructure market in Bangalore still face several challenges. Firstly, the Indian market is highly price-sensitive, posing a certain obstacle to the widespread adoption of electric vehicles. Secondly, the pace of infrastructure development needs to match the growth rate of the electric vehicle market, which may become a bottleneck in the short term.

However, there are significant opportunities in Bangalore's new energy electric vehicle and charging infrastructure market. With technological advancements and cost reductions, electric vehicles are expected to become more widely adopted. Additionally, Bangalore's capacity for technological innovation can drive the development of electric vehicle-related technologies such as battery technology and charging infrastructure. Government policy support and subsidies will also continue to foster market growth.

In summary, Bangalore's new energy electric vehicle and charging infrastructure market are in a phase of rapid development, facing multiple challenges and opportunities. Government policy support, technological advancements, cost reductions, and the unlocking of market potential will collectively propel the growth of this market.

In Bangalore, India, the new energy electric vehicle and charging pile industry can be subdivided from various perspectives, including vehicle types, charging infrastructure, and market participants. Here is an in-depth analysis of these segmented markets:

Vehicle Type Segmentation:

1. Light Electric Vehicles: This category includes electric bicycles, electric motorcycles, and electric scooters, which are highly popular for short-distance travel within Bangalore.

2. Electric Three-Wheelers: Serving as a crucial component of urban transportation, electric three-wheelers offer an economically efficient mode of travel.

3. Electric Passenger Cars: With technological advancements and cost reductions, the market share of electric passenger cars is gradually increasing in Bangalore.

4. Electric Commercial Vehicles: This category comprises electric trucks and electric buses, playing a pivotal role in reducing urban pollution and improving energy efficiency.

Charging Infrastructure Segmentation:

1. Home Charging Equipment: Provides convenient home charging solutions for electric vehicle owners.

2. Public Charging Stations: Located at key points in cities, these stations offer fast charging services.

3. Dedicated Charging Stations: High-power charging facilities specifically designed for commercial electric vehicles.

Market Participant Segmentation:

1. Vehicle Manufacturers: Including international brands and local startups, they play a crucial role in driving innovation in electric vehicle technology.

2. Component Suppliers: Provide batteries, motors, and other critical components required for electric vehicles.

3. Service Providers: Including charging station operators and maintenance service providers, they offer necessary support to electric vehicle users.

Government Policies on New Energy Electric Vehicles and Charging Stations in Bangalore, India

In order to promote the development of new energy electric vehicles and charging stations, the Indian government has implemented a series of policy measures. These policies aim to stimulate the growth of the electric vehicle market through financial subsidies, demand incentives, and infrastructure development.

1. Financial Subsidies and Demand Incentives:

- Buyer Subsidies: The government provides direct price subsidies to purchasers of electric vehicles, reducing the cost of purchasing for consumers.

- Manufacturer Subsidies: Production subsidies are provided to manufacturers of electric vehicles, encouraging enterprises to increase production of electric cars.

- Operator Subsidies: Operational subsidies are provided to operators of electric vehicles to support the commercial operation of electric cars.

- Charging Station Installation Subsidies: Installation subsidies are provided for charging stations for electric vehicles to accelerate the construction of charging infrastructure.

2. Infrastructure Development:

- Building Regulations: Residential and commercial buildings are required to allocate a certain proportion of parking spaces for electric vehicle charging facilities, and the charging fees can be included in the property fees paid by owners. At the same time, it is suggested that these buildings should allow external vehicles to use the charging facilities for a fee.

- Charging Facility Guidelines: The Indian Ministry of Power has issued guidelines and standards for electric vehicle charging facilities, specifying the construction requirements and standards for charging facilities. The new guidelines also make specific provisions for the construction density of charging stations, such as at least one public charging station in specific intervals and at least one public charging station on both sides of the road at certain distances.

3. Charging Standards and Technical Requirements:

- Charging Standards: India primarily follows IEC standards and has developed its own standards to harmonize electric vehicle-related standards with the global electric vehicle industry. India accepts all types of charging protocols, including CHAdeMO, GB/T, and CCS.

Charging Interfaces: The charging interface standards in India are relatively fragmented, lacking a unified national standard interface requirement. Currently, the main charging interfaces are CCS and CHAdeMO, considering factors such as high power, compact integrated interface size, and support for both AC and DC charging.

Policy Implications: The implementation of these policies has significant implications for the development of the new energy electric vehicle and charging station market in Bangalore, India. Financial subsidies and demand incentives directly reduce costs for consumers and businesses, stimulating market expansion. Guidance on infrastructure construction and the establishment of standards provide clear development directions for the market, accelerating the construction of the charging network. The formulation of charging standards and clear technical requirements support industry technological advancement and product standardization.

The series of policies implemented by the Indian government have created favorable conditions for the development of the new energy electric vehicle and charging station market in Bangalore, driving rapid growth and technological innovation in the market. With further policy implementation and market maturity, Bangalore is expected to make greater progress in the field of new energy electric vehicles and charging stations.

Market Trends in the New Energy Electric Vehicle and Charging Station Market in Bangalore, India:

Market Size and Growth Forecast: The market size of the new energy electric vehicle and charging station market in India's Bangalore is projected to increase from $5.61 billion in 2023 to $37.68 billion by 2028. The compound annual growth rate (CAGR) during the forecast period (2023-2028) is estimated at 46.38%. This significant growth reflects the strong demand for new energy solutions in the market and the proactive efforts of both the government and the private sector in promoting electrification.

Government Policies and Support: The Indian government's subsidies for the deployment of charging infrastructure have increased from ₹10 billion (approximately $134 million) in 2018 to ₹100 billion (approximately $1.34 billion) now. This fiscal incentive measure demonstrates the government's attention to the new energy electric vehicle and charging station market and provides clear development signals for market participants.

Technological Advancements and Cost Reductions: Technological advancements, particularly in battery technology, have led to significant cost reductions, which are crucial for the growth of the electric vehicle market. The continuous decrease in the cost of lithium-ion batteries has a positive impact on the growth of the electric vehicle market. Additionally, as electric vehicle-related technologies continue to innovate, including electric vehicle connectivity, autonomous driving technology, and intelligent management systems, the market's acceptance of new energy electric vehicles is also increasing.

Market Drivers: The rise in fossil fuel prices is considered one of the primary factors driving the growth of the electric vehicle market. With the soaring prices of gasoline and diesel, the operating costs of fuel-powered vehicles have also increased, prompting consumers and businesses to consider more economical and environmentally friendly electric vehicle options.

Industry Activities and Exhibitions: For example, the EV INDIA 2024 exhibition for new energy electric vehicles and charging stations will be held in Noida in 2024. This is the largest exhibition of new energy electric vehicles in northern India, showcasing the latest technologies and products from India and abroad. Such industry events not only provide a platform for market participants to showcase and network but also offer consumers an opportunity to learn about the latest market trends and technologies.

Market Challenges: Despite optimistic market prospects, the Indian new energy electric vehicle and charging station market still faces some challenges. The inadequate charging infrastructure is a major obstacle to the widespread adoption of electric vehicles. Additionally, consumer hesitation towards new technologies and the relatively high initial purchase costs of electric vehicles also affect the market penetration rate.

Future Outlook: With government policy support, technological advancements, and cost reductions, the new energy electric vehicle and charging station market in Bangalore is expected to continue its rapid growth. Market participants need to focus on technological innovation, cost control, and changes in consumer demand to seize market development opportunities.

In summary, the Indian new energy electric vehicle and charging station market in Bangalore is undergoing a period of rapid transformation. Government policy support, technological advancements, and cost reductions are key factors driving market growth. Despite challenges, the overall trend of the market is positive, with significant growth and development expected in the coming years.

Overview of the New Energy Electric Vehicle and Charging Station Industry in Bangalore, India

The new energy electric vehicle and charging station industry in Bangalore, India, is experiencing rapid development. Here is an in-depth analysis of the industry, including market size, growth potential, key participants, and policy environment.

The market size of India's new energy electric vehicle and charging station industry is projected to grow from $5.61 billion in 2023 to $37.68 billion in 2028, with a compound annual growth rate of 46.38%. This significant growth is primarily driven by government policy support, increased environmental awareness, and technological advancements.

As the tech hub of India, Bangalore is home to several internationally renowned brands and companies, such as Tesla, Volkswagen, Toyota, Nissan, Geely, Audi, BMW, Volvo, and others. Additionally, there are local innovative enterprises such as Mahindra&Mahindra, Tata Motors, Olectra Greentech, MG Motor India, playing vital roles in the field of new energy electric vehicles.

印度政府通过FAME-II计划,提供了电动车购买补贴,推动了电动车的销售。此外,政府还提供了税收优惠和资金支持,以促进电动车产业的发展。

技术进步是推动电动车产业发展的关键因素。班加罗尔的企业在电池技术、充电基础设施、电动车联网技术、自动驾驶技术等方面不断创新。这些技术的进步不仅提高了电动车的性能,也改善了用户体验。

尽管市场增长迅速,但印度电动车产业仍面临一些挑战,包括充电基础设施的不足、消费者对电动车的认知不足、以及电池成本的高昂。然而,随着技术的进步和政策的支持,这些挑战也带来了巨大的机遇。

总的来说,印度班加罗尔的新能源电动车及充电桩产业正处于一个快速发展的阶段,市场潜力巨大。随着政府的支持和技术的进步,预计这一产业将在未来几年内继续保持高速增长。

六、印度班加罗尔新能源电动车及充电桩市场动态

印度班加罗尔的新能源电动车及充电桩市场正在经历一个快速发展的时期,这一市场的活力和变化反映了新能源解决方案的强烈需求。预计从2023年的56.1亿美元增长到2028年的376.8亿美元,这一显著的增长主要得益于政府的政策支持、技术进步、以及消费者对环保和可持续交通解决方案的日益关注。

政府对充电基础设施的部署提供了大量补贴,从2018年的100亿卢比增加到现在的1000亿卢比,这种政策支持为市场提供了强有力的推动力。同时,技术创新是推动市场发展的关键因素。班加罗尔作为技术创新的中心,将举办多场行业展会,如2024年印度新德里新能源电动车及充电桩展EvExpo 2024。这些展会将展示电动汽车在技术、设计、智能、安全等方面的最新进展,并促进行业内的合作与交流。

市场需求呈现出增长和多元化的特征,受到了能源安全、环境保护、经济效益、社会责任等因素的驱动。随着消费者对电动车认知的提高,以及电动车性能的不断优化,预计市场需求将持续增长。尽管市场前景乐观,但班加罗尔的新能源电动车及充电桩市场仍面临一些挑战。充电基础设施的不足、消费者对电动车的认知不足、以及电池成本的高昂是市场发展的主要障碍。然而,随着技术的进步和政策的支持,这些挑战也带来了巨大的机遇。

总的来说,印度班加罗尔的新能源电动车及充电桩市场正处于一个快速发展的阶段,面临着多重挑战和机遇。政府的政策支持、技术进步、成本降低以及市场潜力的释放,都将共同推动这一市场的成长。随着政府对新能源汽车行业的持续支持,以及全球对环保和可持续发展的重视,班加罗尔有潜力成为印度乃至全球新能源电动车市场的领导者。这一市场的未来发展值得期待。

七、印度班加罗尔新能源电动车及充电桩品牌市场占有率

印度班加罗尔的新能源电动车市场虽然起步较晚,但近年来发展迅速。根据最新的市场研究报告,新能源汽车在印度占2.4%的市场份额,实现了高达137%的同比增长,销量达到4.8万辆。虽然目前电动汽车在印度新车销售总额中的占比不到1%,但预计到2030年,电动车销量将占总销量的7%左右。

主要品牌与市场占有率:在班加罗尔,国际知名品牌如特斯拉、大众、丰田、日产、吉利、奥迪、宝马、沃尔沃等都在积极布局市场。同时,本土品牌如Mahindra&Mahindra、Tata Motors、Olectra Greentech、MG Motor India等也在市场中占有一席之地。这些品牌通过提供多样化的产品线和竞争力的价格策略,争夺市场份额。

市场竞争与发展:班加罗尔的新能源电动车市场竞争激烈,各品牌之间在技术创新、产品质量、服务体系等方面展开竞争。随着技术的进步和成本的降低,电动车的性能和续航能力得到了显著提升,消费者的接受度也在不断增加。此外,政府的政策支持和补贴也为市场的发展提供了有力的推动。

充电桩市场:充电桩市场作为新能源电动车发展的重要支撑,其市场占有率同样重要。班加罗尔的充电桩市场目前由多家企业参与,包括国际和本土的充电设备运营商。政府对充电基础设施的部署提供了大量补贴,从2018年的100亿卢比增加到现在的1000亿卢比,极大地促进了充电桩市场的发展。

随着印度政府对新能源汽车行业的持续支持,以及全球对环保和可持续发展的重视,班加罗尔有潜力成为印度乃至全球新能源电动车市场的领导者。品牌市场占有率的变化将继续受到技术创新、政策导向、市场需求等多重因素的影响。

印度班加罗尔的新能源电动车及充电桩品牌市场占有率的分析显示出该市场正处于快速发展阶段,各大品牌正通过技术创新和市场策略来争夺更大的市场份额。随着市场的进一步成熟和政府政策的支持,预计班加罗尔的新能源电动车及充电桩市场将迎来更加广阔的发展前景。这一市场的未来发展值得期待。

组展单位:东方福泰(北京)国际会展有限公司

微信服务号:展会圈